Blog

2 minutes

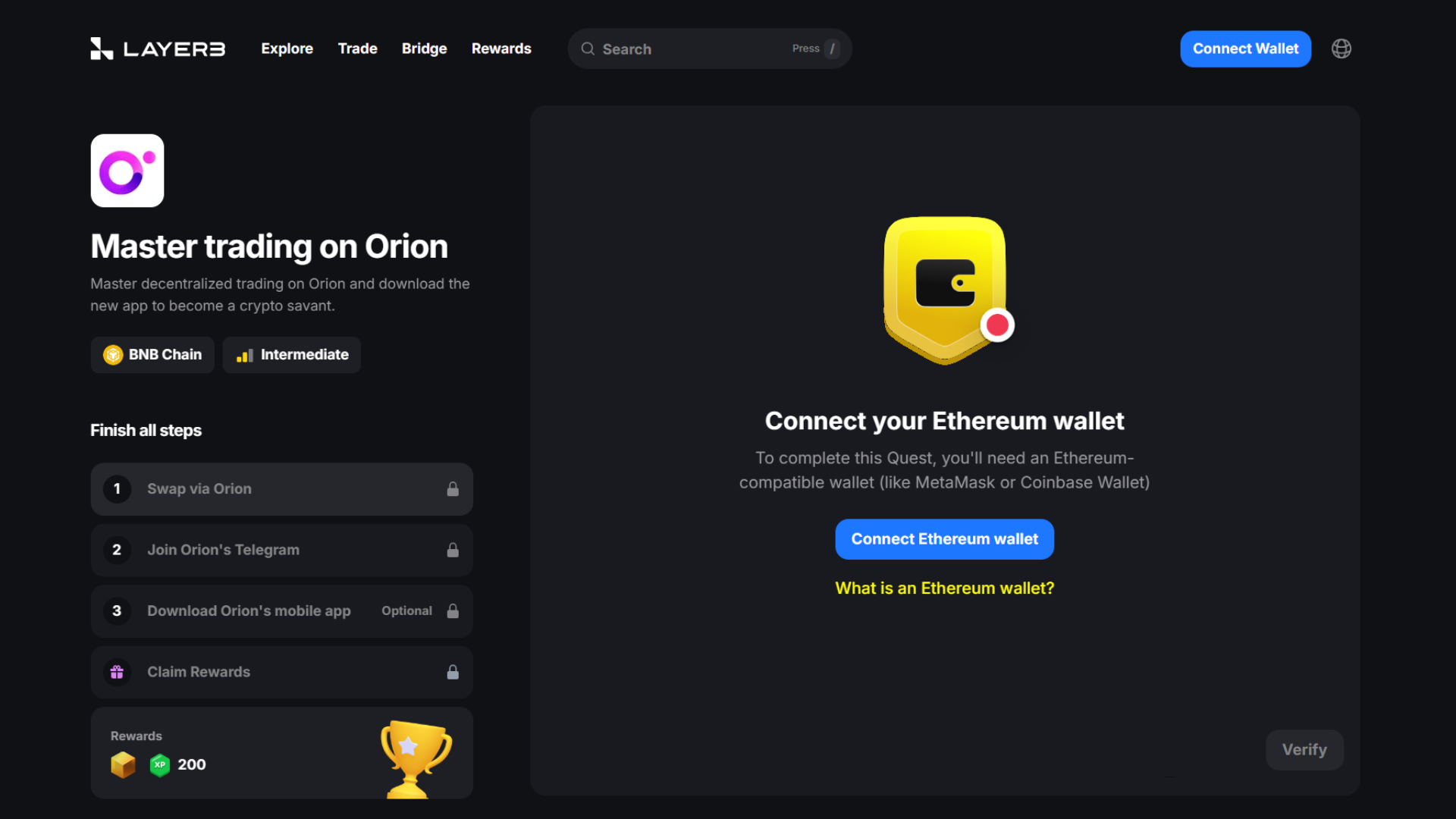

Unlock Massive XP Rewards: Layer3 Quests are Back 🟣

Earn Rewards with Layer3 Orion has once again teamed up […]

4 minutes

STEPN deCEX Trading – Only on Orion 🟣

Trade GMT at unbeatable real-time deCEX rates through top exchanges […]

2 minutes

Introducing Orion iOS App: Crypto & DeFi Simplified

We are delighted to announce the launch of the highly […]

3 minutes

Unlimited Wealth: Refer & Earn is Open + Incredible 🟣

Are you ready to start rewarding your uncapped potential with […]

2 minutes

Lumia CBA: Meet The Brain Behind The Blockchain

Deniz Dalkilic joins Lumia as Chief Blockchain Architect to help […]

3 minutes

Lumia (ORN): The First Hyper-Liquid Layer 2

Lumia is now a layer 2 blockchain with its natively […]

1 minute

Lumia (ORN) Bolsters Linea With CEX Liquidity

Lumia (ORN) partners with Linea to introduce first-ever centralized exchange […]

1 minute

Lumia (ORN) Expands Into RWAs With MANTRA Partnership

Lumia partners with MANTRA and commits to an expansion into […]

2 minutes

1inch Integrates Lumia for its Millions of Users

1inch has successfully integrated Lumia as a liquidity source, bringing […]

2 minutes

Lumia and Waves Partner to Bring the Deepest Liquidity in DeFi to the Waves Ecosystem

Lumia solidifies itself as the omnichain liquidity layer of Web3. […]

1 minute

New Ex-Binance CBDO: Lumia Team Grows

U-Chyung Lim joins Lumia to solidify strategic partnerships and propel […]

1 minute

Lumia Recreates The Entry Point to DeFi for opBNB Builders

For the first time ever, Lumia enables all builders on […]